vehicle sales tax in memphis tn

The 2018 United States. Did South Dakota v.

Web Used Car Sales Tax In Memphis Tn.

. WarranteeService Contract Purchase Price. The December 2020 total local sales tax rate was also 9750. The Tennessee sales tax rate is currently.

Web Obtaining a Title Transfer or New Vehicle Title Tennessee State law requires that any vehicle operated on the roads of Tennessee be properly titled registered and that appropriate sales tax be paid on the transfer of any vehicle whether purchased from an individual or a dealership. The general state tax rate is 7. Local Sales Tax is 225 of the first.

Web The minimum combined 2021 sales tax rate for memphis tennessee is. Web Memphis collects the maximum legal local sales tax. Tennessee sales and use tax rule 1320-05-01-03 Charges made by a dealer to customers for title fees are considered pass through charges excludable from the sales price of the motor vehicle or boat.

M-F 8am - 5pm. Old Courthouse 300 Main Street Knoxville TN 37902. Web Vehicle Sales Tax Calculator.

Kingsport TN 37660 Phone. Web Property tax refunds are generally processed within 60 days after receipt of assessment change information from the Shelby County Assessor or the Board of Equalization and the appropriate submission of required documents to the City Treasurer Office. Kingsport TN 37660 Phone.

There is no applicable special tax. Memphis TN 38103 Phone. Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2614 on top.

The city with the lowest car sales tax is Mountain City with a car sales tax rate of 85. February 09 2022 0805. Vehicle Sales Tax Calculator.

Web This page covers the most important aspects of Tennessees sales tax with respects to vehicle purchases. Web What is the sales tax rate in Memphis Tennessee. Did South Dakota v.

Web The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Tennessee collects a 7 state sales tax rate. Sales Tax State Local Sales Tax on Food.

Please click on the links to the left for more information about tax. Web motor vehicle or boat is subject to the sales or use tax. Web Vehicle sales tax in memphis tn.

Title fees should be excluded from the sales or use tax base when Motor vehicle or boat is subject to the sales or use tax. The Tennessee sales tax rate is currently. Title fees should be excluded from the sales or use tax base when.

View our landers used inventory to find the right vehicle to fit your style and. Express van car rental. For vehicles that are being rented or leased see see taxation of leases and rentals.

Web The city with the highest car sales tax in Tennessee is Memphis with rates of 975. County Clerk Main Office. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Between spouses siblings lineal. In other words be sure to subtract the trade-in amount from the car price. WarranteeService Contract Purchase Price.

Web VTR-34 - Sales Tax on a Vehicle Purchase. Web TN registration renewal. For purchases in excess of 1600 an.

Please keep in mind that each county may also have a wheel tax and local tax which vary depending on the county. Wayfair Inc affect Tennessee. The Memphis sales tax rate is.

Car Sales Tax for Trade-Ins in Tennessee. Purchasers of new and used vehicles must pay state sales tax at the rate of 7 percent and the state single-article tax at the rate of 225 percent. Web TENNESSEE SALES TAX AND OTHER FEES.

Web Memphis TN Sales Tax Rate. The sales tax calculator is for informational purposes only please see your motor vehicle clerk to confirm exact sales tax amount. Bristol TN 37621 Phone.

Real property tax on median home. You can print a. City Treasurers Information Line.

This is the total of state county and city sales tax rates. You dont have to pay sales tax on trade-ins. M-F 8am - 5pm.

Save up to 5559 on one of 58 used cars for sale in memphis tn. How 2021 sales taxes are calculated in memphis. The minimum combined 2022 sales tax rate for Memphis Tennessee is.

The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis tax. The current total local sales tax rate in Memphis TN is 9750. The County sales tax rate is.

Motor Vehicles Title Applications. Web The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. The sales tax is comprised of two parts a state portion and a local portion.

M-F 8am - 5pm. There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes. The highest the combined citycounty rate can be is 275.

Web Tennessee State Government - TNgov. Used Cars Under 15000 For Sale In Memphis Tn Autonation. The local tax rate varies by county andor city.

Railpictures Net Photo Mata 455 Memphis Area Transit Authority Mata Melbourne Metropolitan Tramways Board W2 At Memphis Te Memphis Metropolitan Tennessee

3785 W Germanwood Ct Memphis Tn 38125 Mls 10121042 Redfin

4675 Raleigh Lagrange Rd Memphis Tn 38128 Realtor Com

Hot Rod Volume 28 Issue 11 November 1975 Hot Rods Car Enthusiast Gift Van Tyres

Crazy Hot Deals Memphis Tn Home Facebook

Sales Tax On Cars And Vehicles In Tennessee

10 Pros And Cons Of Living In Memphis Tn Right Now Dividends Diversify

Cars For Sale In Memphis Tn Carsforsale Com

New Audi Cars Suvs For Sale In Memphis Tn Audi Memphis Near Southaven

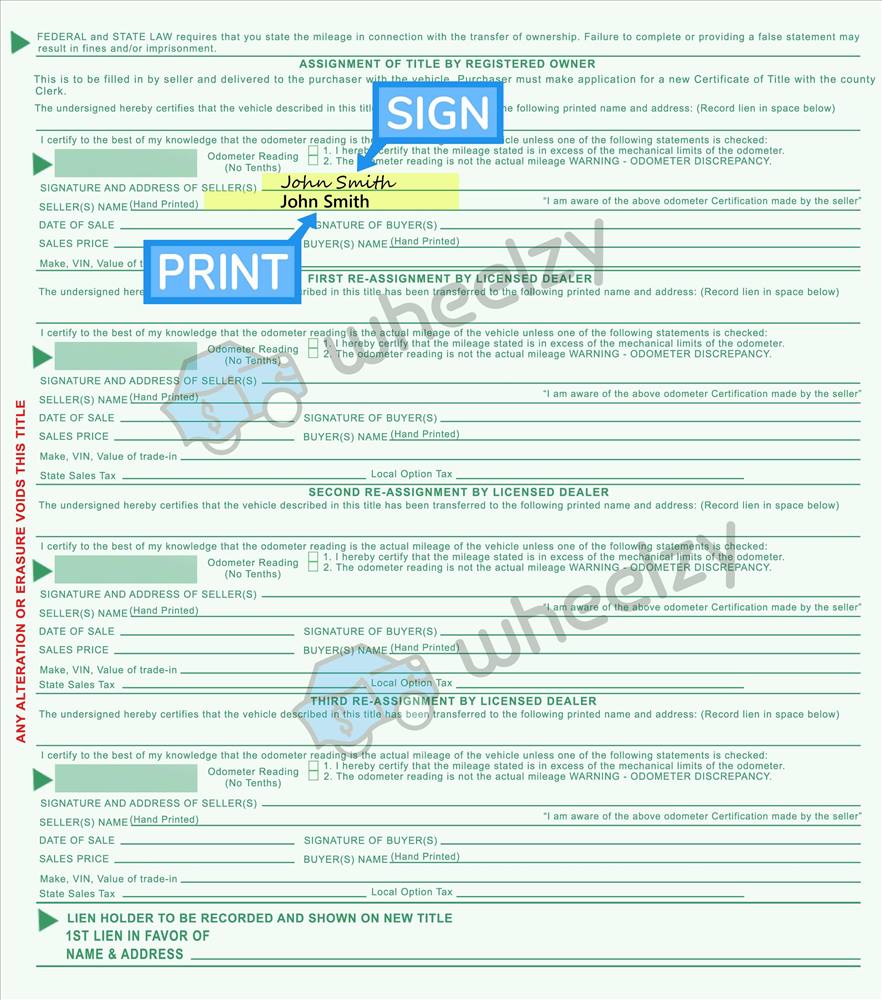

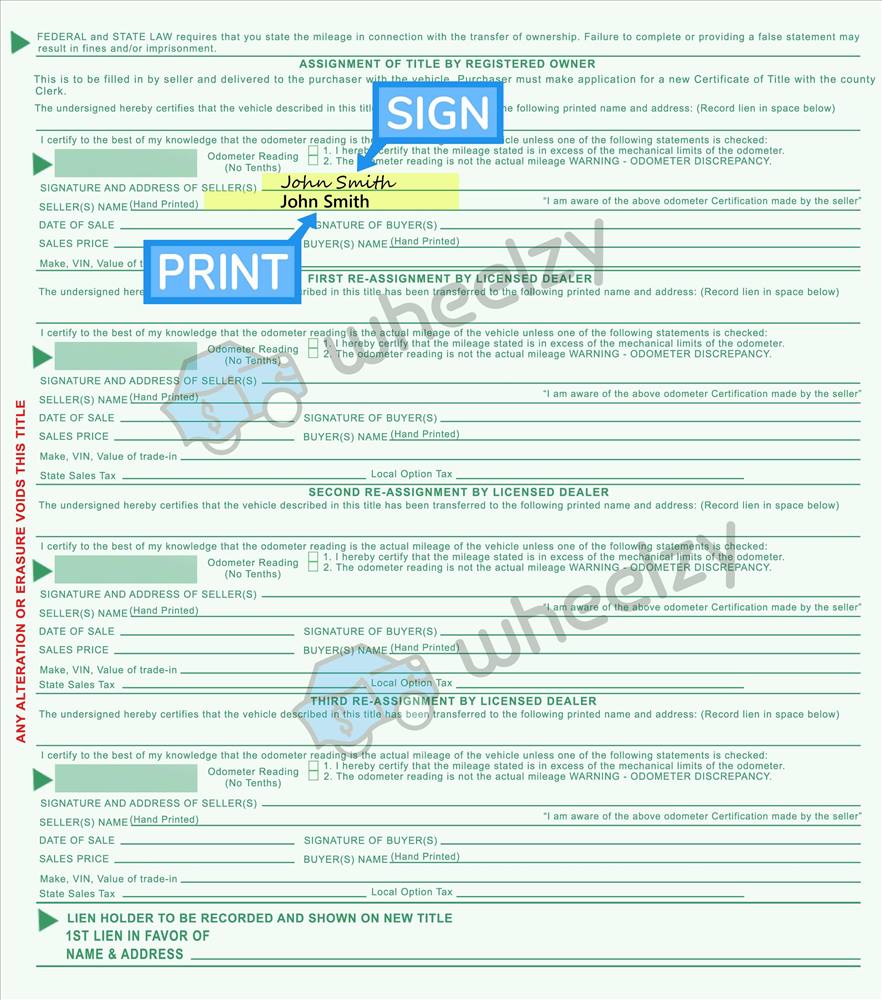

How To Sign Your Car Title In Memphis Including Dmv Title Sample Picture

3645 Twinmont St Memphis Tn 38128 Realtor Com

3620 Hallbrook St Memphis Tn 4 Beds 2 Baths Exterior Brick Memphis Real Estate Sales

Tn Dept Of Revenue Tndeptofrevenue Twitter

3910 James Rd Memphis Tn 38128 Realtor Com

245 S Mendenhall Rd Memphis Tn 38117 Realtor Com

1745 Myrna Ln Memphis Tn 38117 Realtor Com

Memphis Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders